Update May 2020

On 18 March 2020 the government suspended all aviation related pricing reviews due to the impacts of the COVID-19 pandemic.

This means that the proposed changes to the pricing of CAA fees, levies and charges that were presented to the sector in late 2019/early 2020 will not proceed at present. When a decision is made to re-consider pricing, the Authority will ensure the sector is advised and engaged to discuss proposals and options.

In the meantime, the Authority would like to thank those who provided submissions – we realise that this involved a lot of work. All feedback was collated and analysed. The information provided was very helpful and as a result, elements of the proposals were being revisited. So, whilst the current review is on hold, the information provided by the sector will certainly help to inform future thinking.

A review of CAA fees, levies, and charges is under way, and you're invited to comment by 14 Feb 2020 (please note that in response to requests for more time, this date is extended by a week from the initial date of 07 Feb 2020).

This review will consider the pricing level of the fees, charges, and levies, not the funding framework that was reviewed in 2017. Any changes are expected to take effect 01 July 2020 and remain until 2023.

The approach adopted in this pricing review is consistent with the Government’s ‘cost recovery’ objectives and complies with the public sector guidelines on the setting of fees and charges for services by government agencies. These guidelines were developed by Treasury and the Auditor-General.

Read the full discussion document [PDF 1.7 MB]

Learn more in the cabinet paper(external link)

This review is to ensure the Authority’s fees, levies, and charges are set at levels allowing the Authority to carry out the full scope of its work over the next three years.

The CAA will consult until 5 pm 14 February 2020 on the changes proposed by the 2020 pricing review agreed to by cabinet. We want advice and views on the proposals and their possible impact.

Here are some of the questions and answers that aros during consultation and public meetings.

Authority pricing review 2020 - sector meetings feedback and responses [PDF 73 KB] - Jun 2020

Questions and answers 05-11 Feb 2020 [PDF 34 KB]

In the 2012 pricing review, reference was made to the need to increase fees and charges to fund a significant upgrade in technology and that such upgrade would be funded from a mix of retained earnings and a loan. Is the upgrade that is now being proposed the same upgrade as proposed in 2012?

The planned upgrade is to replace the same platform, but is an alternative solution to that originally considered and evaluated. The Authority has now selected an off-the-shelf product that significantly de-risks implementation.

Are the income and expenditure projections in the Cabinet document associated with the package of information dated November 2019 representative of the actual anticipated income and expenditure of CAA or is it simply a model used to justify price adjustments?

The income and expenditure projections are represented on anticipated income and expenditure.

What is the budgeted income and expenditure for the year ending 30 June 2020?

See the Statement of Performance Expectations 2019-2020 [PDF 1.7 MB] (ref pages 22 to 26)

How much income was forgone over the period from FY2018 to FY2020 subsequent to removing the charge for surveillance?

No income was forgone. The cost recovery framework for the regulatory functions of the Authority was re-framed on the basis that monitoring and inspection activity is more accurately classified as a ‘club’ good, and thus according to the Government’s principles for cost recovery, cost recovered by a levy.

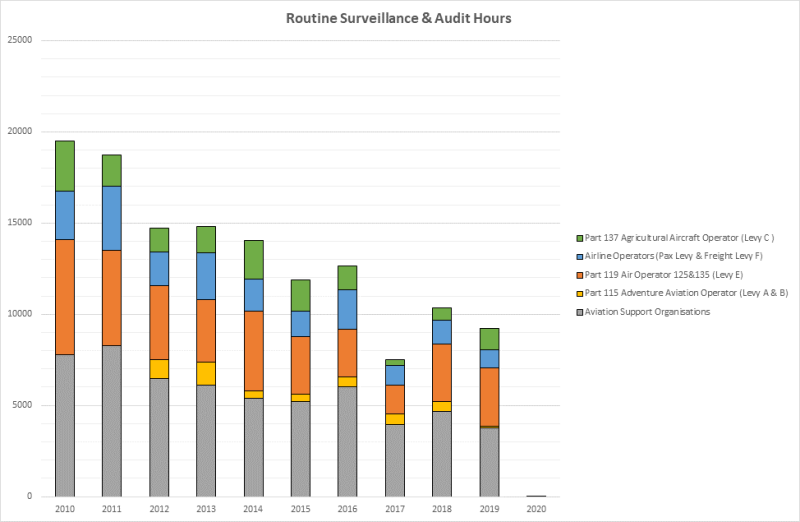

What is the total number of hours expended on routine audits each year from 2012 to the present day, and if possible the audit hours per CAA levy sector group classification?

The information you have requested is below. Please note that significant effort is currently being deployed against certification of Group 2 operators Safety Management Systems prior to the implementation deadline.

For the years 2014/15, 2015/16, 2016/17, 2017/18, 2018/19 and 2019/20 (to date) and Rule Parts 115, 125, 135 and 137:

How many routine audits and inspections were carried out by the CAA for each year, by each rule part? A matrix with years on one axis and rule parts on the other is fine.

Number of Audits and Inspections by Rule Part [PDF 634 KB]

For each year and each rule part, please advise how many major findings, minor findings and critical findings, all shown separately, were issued?

Audit Findings by Rule Part and Finding Type [PDF 631 KB]

The reduced audit numbers in recent years are due to the requirement to certificate operators under CAR Part 100 Safety Management prior to 21 February 2021.

Under Authority priorities, certification is placed higher than monitoring and inspection (audits). Analysis shows that on average, an SMS certification requires 97 staff hours to complete (not all of which is charged to the participant).

There are currently 348 organisations that require SMS certification. Once this is completed in February 2021, staff will be available to increase monitoring and inspection activity.

The relative risk profiles of the specific sector groups ranking from the highest to the lowest risk?

We do not hold information that ranks the risks of sectors from highest to lowest. The Authority does calculate risk scores for certificate holders on an individual basis. However, this data is not aggregated to calculate risks scores by sector. We have completed some sector risk profiles, in conjunction with specific sectors (eg, the Part 135 sector risk profile), and information on these is available on our website. Visit Sector Risk Profiles.

The Treasury authority to provide for a 3% annualised increase in salaries?

Treasury does not authorise remuneration increases. The Authority recruits its personnel from both the wider state sector and private sector, and calculates anticipated remuneration movements based on available market data.

Whether the business case has been made to approve the replacement of the legacy regulatory systems technology, and if the business case has been approved can we please have a copy of that document?

The Authority Board has approved a business case for the replacement of the Authority’s core regulatory business system. However, as that business case contains commercially sensitive information, and the Authority will be moving into a negotiation with the preferred vendor, the business case is withheld under Section 9 (2) (b) (ii) of the Official Information Act, 1982 as making available the information would likely unreasonably prejudice the commercial position of the person who supplied or who is the subject of the information.

If we are unable to receive a copy of the business case, a comprehensive financial analysis of the duration of the project and what likely/probable savings will be incurred in terms of personnel and other operating costs?

As with question 10, the Authority has yet to finalise negotiations with the vendor of preferred IT/IS solution, and at this point, the information requested is commercially sensitive and we are withholding the information under Section 9 (2) (b) (ii) of the OIA as mentioned above. The proposed solution is unlikely to lead to any significant savings in personnel costs.

The funding paper notes that income from the introduction of SMS has been in excess of budget but this is expected to reduce over the period of the funding review. Can CAA please advise what if any costs from the introduction of SMS will reduce over the same period of time?

The income associated with SMS certification has been higher than anticipated for some certificate holders; reflecting the amount of work that has been required for SMS’s to be certificated to the requisite standards for some certificate holders. As the introduction phase of SMS comes to an end, the Authority does not anticipate that the revenue currently being generated through the introduction phase, for certification activities, will continue.

A copy of the communication advising CAA that government will no longer fund HASNO?

See the estimate of appropriations for the 2018/19 and 201/20 financial years in which the fixed term appropriation for HAZNO activity was received. This information can be found on the Treasury website(external link), search on “estimates of appropriations”.

How was it determined that CAA would need to recover around $0.5m in respect of HASNO and what does this comprise?

The quantum contained in the consultation document is less than the appropriation for the activity. The activity the current proposals would cost recover for include the oversight and other regulatory functions associated with the Authority’s designation as the HASNO agency for products dispersed from aircraft.

How was it determined that 90% of the cost would be allocated to the Ag Sector levy and 10% of the cost to all other fees and charges?

The Authority’s best estimate is that 90% of products dispersed from aircraft are dispersed by agricultural aircraft given the quantity of fertiliser and other products dispersed from agricultural aircraft.

On what date was the contract signed to acquire the EMPIC-EAP technology platform?

A number of discussions have been held with the vendor with respect to the Authority’s proposed acquisition of the product and draft contract terms have been agreed, but no contract has yet been signed with EMPIC-EAP.

What are the additional surveillance personnel for and how will they be allocated by sector. Also, on what basis did the CAA conclude that additional surveillance personnel are required?

The Authority is currently shifting its regulatory functions from a sector-facing to functionally orientated organisational design. This will result in a monitoring and inspection function being established, with some increase in staffing numbers reflecting growth in the oversight of some sectors such as RPAS.

Why is mention made of drone operations when no new charges relating to them are included in the document?

The Authority, as discussed in the discussion document, has considered whether there is a basis for recovering oversight costs from the “RPAS sector”. However, the Authority concluded that there is no efficient basis, currently, to recover oversight costs from the RPAS sector until other issues related to the future regulations for that sector are resolved. This latter work is being led by the Ministry of Transport, and includes consideration of those matters listed in the discussion document. The information has been included in the discussion document for the sake of completeness and transparency.

Why is the contribution of government/crown funding reducing during the period?

The Government’s contribution, in actual dollars, is forecasted to remain stable. The Authority is not anticipating any increase in the appropriations it currently receives for those functions it undertakes for the Crown (such as policy activity), and is anticipating a reduction in relation to funds for HAZNO related activities.

Can you please advise what portion of Output Class One was funded by passenger/aviation safety levy in the last three financial years?

Please see the annual reports for those years, which provides information about the expenditure (and sources of revenue) for those activities undertaken in Output Class 1.

Are there any efficiency gains in CAA throughout the three years under this funding review? If there are, what are they and what are the projected savings?

The CAA is not forecasting any material efficiency gains in the triennium of the review period; although the CAA will continue to focus on ensuring that it manages its business in an efficient and effective manner. As the financial information indicates, the CAA is intending to manage a number of cost pressures within the forecast expenditure, thereby reflecting an inherent efficiency gain in its operations.

The extent of the cross subsidy from Aviation Security to cover administrative functions of CAA and if the two agencies where no longer linked in this manner how much CAA’s costs would increase presuming there would be some efficiency gain from no longer requiring the number of personnel to run “back of office functions”?

There is no ‘cross-subsidy’ between Avsec and the CAA. The services provided by the CAA to Avsec (such as human resources, finance, information systems and technology, legal, etc) are costs recovered from Avsec to the CAA.

(Wages + Salaries + Overheads) / Number of FTE employees for each of the last 5 years?

The Authority’s Annual Reports provide this information.

What levy income was collected by sector group for the years ended June 2018; June 2019 and what levy income is projected by sector group for the year ending June 2020?

Levy revenue by sector, by year [PDF 80 KB]

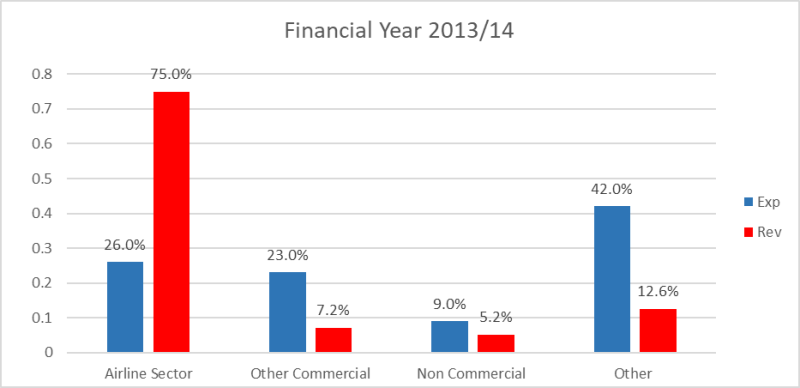

Attached is a document the CAA produced for the previous review of fees and charges in 2015/2016 which is a breakdown of revenue against costs. Could you please update this information and indicate whether or not the “rebalancing of revenue” has been achieved?

There is a significant favourable variance of income over the period FY2017 to FY2019 relative to that placed before Cabinet at the time of the 2015/2016 funding review. What has been the primary driver for this? See the Authority’s annual reports for the 2017/18, 2018/19 and 2019/20 for detailed information on this matter.

The primary reason has been higher than forecast revenues associated with passenger volumes for both domestic and international travel, resulting in higher than forecast revenue for associated safety levies.

In the last three years additional Crown money has been received so the Authority can deliver its responsibilities around Health & Safety at Work Act, Hazardous Substances & New Organisms Act and to assist with the certification of innovative technologies. Additionally there has also been an increase in MFAT funding for Pacific Aid activity.

This table shows the major changes within passenger levies [PDF 67 KB]

There is a significant unfavourable variance of expenditure over the period FY2017 to FY2019 relative to that placed before Cabinet at the time of the 2015/2016 funding review. What has been the primary driver for this and can you please quantify the areas of expenditure?

There are three main drivers to the increase in costs between 2016/17 to 2018/19. The first is personnel costs.

The second driver is in "Other cost of services" and is directly related to the cost of building increased resilience into the Authority partly in response to the 2016 Kaikuora earthquake. This has led to increased costs of equipping personnel to be able to work remotely and moving key IT platforms to cloud hosting solutions, increasing annual computer licencing costs.

The third driver is also related to Pacific aid work as this includes training, conferences and equipment for the pacific region, however these costs are recovered through MFAT, under the Ministry Contracted revenue income.

Table of expenditure [PDF 68 KB]

The terms upon which the lease of CAA’s premises has been renewed and on what date is the next lease renewal due?

The CAA Lease for Level 15 and part Level 14 of Asteron Centre was renewed for a further term of 6 years from 1 December 2019, under the same terms and conditions of the current Deed of Lease.

The next Right of Renewal under the Deed of Lease is due as at 1 December 2025. This will be the second of a total of three Rights of Renewal available under the Lease.

If all available Rights of Renewal are exercised by CAA (at its sole discretion), the Final Expiry of the Deed of Lease for the premises will be 30 November 2037.

Has this review been conducted in accordance with the Treasury guidelines on fees and charges dated April 2017? If so can you please advise the following:

a. What basket of services were used to benchmark CAA fees and charges?

b. What non-financial efficiency performance measures have been introduced to demonstrate that CAA is delivering value for money?

c. What initiatives have been taken to demonstrate to the sector that costs are being controlled?

d. What financial briefings are provided to the Sector?

e. Does the Sector have any ability to question budgets prior to the Board finalising those budgets?

The report 2019 Benchmarking Review: Economy and Efficiency [PDF 2.2 MB] is an update of the original report that was produced in 2017.

This report was produced in July 2019 by the Authority Pricing review 2020 to provide the Authority Board with an indication as to how the CAA is performing compared to other organisations with similar characteristics conducting similar functions.

The 2019 report updated comparisons made in the 2017 report (which reported 2010-2016 data) with 2017-8 data as follows:

The 2019 refresh report sets out the context, the methodology and the limitations of the comparisons that are due to the differences in various services, agencies and jurisdictions and in some cases lack of available data.

It was concluded that on balance the information outlined in the report, within the parameters of the caveats, indicates that the Authority continues to perform in line with other similar domestic and international regulators and agencies as follows:

Average annual training cost per CAA employee for each of the last five years?